lakewood co sales tax online

Colorados Tax-Exempt Forms. The PIF is not a City tax but rather a fee the.

How Are Pch Winners Notified Lotto Winning Numbers Sweepstakes Winner This Or That Questions

City of lakewood 480 s.

. If you are filing online the sales and use tax total due and payable must be paid online using an e-check or credit card. The Belmar Business areas tax rate is 1. Lakewood in Colorado has a tax rate of 75 for 2022 this includes the Colorado Sales Tax Rate of 29 and Local Sales Tax Rates in Lakewood totaling 46.

The Colorado sales tax rate is currently. The City portion 3 must be remitted directly to the City of Lakewood. When making a cash payment be sure to bring your tax billpayment voucher.

The City of Lakewood allows qualifying 501c3 organizations an exemption from Lakewood sales tax when they purchase goods and services for their regular charitable functions and activities. Revenue online rol sales. LCC Performance Now Theatre Company co-present 1776 Published on February 18 2022.

Sales Use Tax System SUTS State-administered and home rule sales and use tax filing. The Lakewood sales tax rate is. Did South Dakota v.

ICalculator US Excellent Free Online Calculators for Personal and Business use. Lakewood co sales tax online filing. License My Business Determine if your business needs to be licensed with the City and apply online.

All businesses selling goods in the City must obtain a Sales and Use Tax License. The minimum combined 2022 sales tax rate for Lakewood Colorado is. The Lakewood Cultural Center and Performance Now Theatre Company present Americas Tony Award-winning musical 1776 March 18-April 3.

Sales Tax Return Due Date. The remainder of the. Appointments are not required to visit the CDOR Cashiers Office but are encouraged for marijuana businesses making cash payments.

For additional e-file options for businesses with more than one location see Using an. Cash payments can only be made at the Pierce Street Department of Revenue Location inside the DMV - Entrance A. The Lakewood Colorado sales tax is 750 consisting of 290 Colorado state sales tax and 460 Lakewood local sales taxesThe local sales tax consists of a 050 county sales tax a 300 city sales tax and a 110 special district sales tax used to fund transportation districts local attractions etc.

Businesses located in Belmar or the Marston Park and Belleview Shores districts have different sales tax rates. If you have more than one business location you must file a separate return in Revenue Online for each location. Download all Colorado sales tax rates by zip code.

The City of Lakewood receives 1 of the 100 sales tax rate. For more information visit our ongoing coverage of. The tax rate for most of Lakewood is 75.

Go to the account you want to close and click Additional Actions For Sales Tax accounts be sure to select the Sales Tax account not your Sales Tax LicenseRenewal accounts. To figure out the taxes on a piece of property with a total assessment of 23377808 the average assessment for a residential property in Lakewood Township in 2011 you would divide 23378808 by 100 233788 and multiply that figure by the tax rate 2. The Lakewood Colorado Sales Tax Comparison Calculator allows you to compare Sales Tax between all locations in Lakewood Colorado in the USA using average Sales Tax Rates andor specific Tax Rates by locality within Lakewood Colorado.

Sales Tax Rates With the exception of the Belmar Business area the sales tax for Lakewood is 3. After you create your own User ID and Password for the income tax account you may file a return through Revenue Online. The ST3 sales and use tax rate of 050 is effective April 1 2017 bringing the total sales and use tax rate for Sound Transit to 140.

For definition purposes a sale includes the sale lease or rental of tangible personal property. Manage your tax account online - file and pay returns update account information and correspond with the Lakewood Revenue Division. Lakewood California Sales Tax Rate 2021 The 1025 sales tax rate in Lakewood consists of 6 California state sales tax 025 Los Angeles County sales tax 075 Lakewood tax and 325 Special tax.

Sales and Use Tax Returns - 2017 and earlier. Retail Sales Tax A 35 Sales Tax is charged on all sales in the City of Englewood except groceries. The breakdown of the 100 sales tax rate is as follows.

FILE AND PAY SALES AND USE TAX ONLINE - 2018 and later. This is the total of state county and city sales tax rates. Sales and use tax returns are due on the 20th day of each month following the end of the filing period.

Log in to Revenue Online. To qualify for exemption an organization must. The lakewood colorado sales tax is 750 consisting of 290 colorado state sales tax and 460 lakewood local sales taxesthe local sales tax consists of a 050 county sales tax a 300 city sales tax and a 110 special district sales tax used to fund.

There are a few ways to e-file sales tax returns. The 2010 tax rate for Lakewood Township is 2308 for every 10000 of assessed value. The County sales tax rate is.

On april 2 2019 the voters of grand junction authorized a 05 increase in the sales and use tax rate for the city of grand junction. Witness the birth of a nation as our forefathers struggle to craft the Declaration of Independence. Wayfair Inc affect Colorado.

You can find more tax rates and allowances for Lakewood and Colorado in the 2022 Colorado Tax Tables. Businesses with 75000 per year in state sales tax must pay by Electronic Funds Transfer Payment When Filing via a Paper Return To ensure your payment is posted to your tax account you must include the eight-digit Colorado Account Number CAN on your check or money order. Note that in some retail areas of the City a Public Improvement Fee PIF may be charged to reimburse the developer for on-site improvements.

If you close your Sales Tax LicenseRenewal account it will not close your entire Sales Tax account.

Business Licensing Tax City Of Lakewood

File Sales Tax Online Department Of Revenue Taxation

Register For A Sales Tax Permit In The State Of Virginia Business Solutions Virginia Sales Tax

2006 City Of Lakewood Sales And Use Tax Return Form Download Fillable Pdf Templateroller

File Sales Tax Online Department Of Revenue Taxation

Homes For Sale Real Estate Listings In Usa Investment Property Property Tax Real Estate Buying

Washington Sales Tax Guide For Businesses

How Colorado Taxes Work Auto Dealers Dealr Tax

File Sales Tax Online Department Of Revenue Taxation

How To Look Up A Colorado Account Number Can Department Of Revenue Taxation

Why Do U S Sales Tax Rates Vary So Much

Sales Use Tax City Of Lakewood

Business Internetmarketing Kindlebooks Marketing Marketingadvice Marketingtips Selfhelp Hvac Company Internet Marketing Free Internet Marketing

How Colorado Taxes Work Auto Dealers Dealr Tax

How Colorado Taxes Work Auto Dealers Dealr Tax

Sales Use Tax System Suts Department Of Revenue Taxation

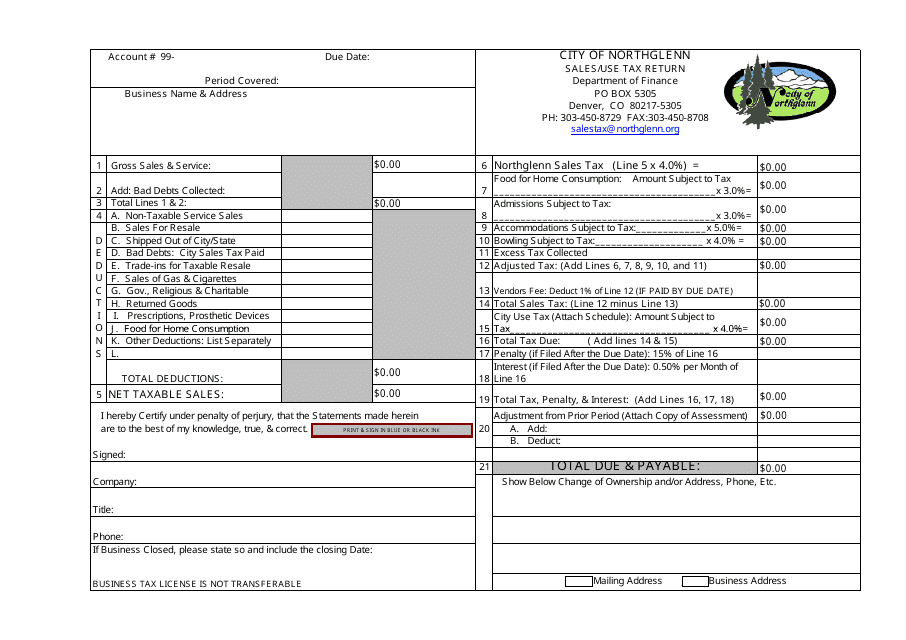

City Of Northglenn Colorado Sales Use Tax Return Form Download Fillable Pdf Templateroller